"Building a global, diversified wealth management ecosystem centered on high-net-worth clients — empowering entrepreneurs and families with enduring value, sustainable legacy, and holistic solutions across people, family, business, and society."

Establishing a family office has become an increasingly popular strategy among ultra-high-net-worth entrepreneurial families to manage their wealth and legacy with precision and care. Unlike traditional bank-based wealth management, a family office offers a holistic suite of services that go far beyond investment.

From financial planning and trust structuring to legal advisory, tax optimization, and philanthropic strategy, family offices provide a 360-degree approach to wealth stewardship. Services also include real estate planning, asset allocation, legacy enhancement, estate planning, and next-generation education—ensuring that both wealth and values are preserved and passed on seamlessly.

With a family office, you gain a trusted partner dedicated to safeguarding your legacy, empowering your family, and supporting your long-term vision.

Family offices deliver comprehensive wealth management solutions, including strategic asset allocation and tailored investment planning and execution. These services are designed to ensure sustained growth of family wealth across all market conditions.

By aligning with each family's unique risk appetite and financial goals, family offices craft bespoke investment portfolios that span equities, bonds, real estate, and a wide range of financial instruments — ensuring a balanced, resilient, and forward-looking approach to wealth preservation and growth.

Family offices provide proactive risk management strategies to safeguard family wealth against financial, market, legal, and inheritance-related risks. Through tailored solutions such as insurance planning and legal structuring, families gain comprehensive protection and peace of mind across generations.

A family office helps design long-term succession plans that go beyond asset distribution—preserving family values, entrepreneurial spirit, and legacy. By establishing family trusts, estate plans, and education funds, the office ensures smooth transitions, minimizes disputes, and protects assets from erosion.

Acting as a strategic advisor, the family office supports business owners with services including IPO planning, mergers and acquisitions, corporate restructuring, exit strategies, and employee stock ownership plans (ESOPs)—empowering sustainable business growth and transformation.

Strong governance builds lasting legacies. Family offices facilitate communication and decision-making among members by establishing family constitutions, governance frameworks, and regular family meetings. They also promote financial literacy and shared values through next-generation education programs.

Family offices play a pivotal role in shaping a family’s legacy through purpose-driven philanthropy and impactful brand building. By aligning charitable initiatives with the family’s values and long-term vision, they help create meaningful social impact while enhancing the family’s public image and influence.

From designing philanthropic strategies to overseeing charitable foundations and impact investments, family offices ensure that every contribution delivers measurable value. At the same time, these efforts strengthen the family’s identity, reputation, and multigenerational legacy—positioning the family as a force for good in both business and society.

Beyond wealth, family offices offer concierge-level support—from personal assistants and lifestyle management to education planning and healthcare coordination—ensuring every aspect of the family’s life is seamlessly managed with discretion and care.

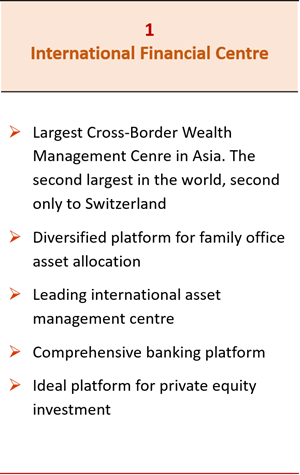

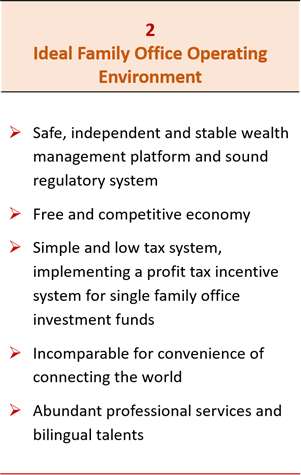

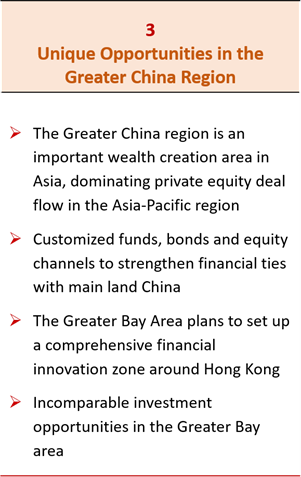

As a premier international financial hub and a globally recognized center for wealth management, Hong Kong offers an exceptional environment for the growth and operation of family offices. With its robust financial infrastructure, world-class professional services, and business-friendly regulatory framework, Hong Kong stands out as a strategic base for managing and preserving family wealth.

Serving as the gateway between Mainland China and the rest of the world, Hong Kong uniquely blends Eastern heritage with Western efficiency. This cultural and economic convergence makes it an ideal location for global entrepreneurial families seeking to build enduring legacies across generations. For families looking to establish a lasting presence in Asia and beyond, Hong Kong is a smart and forward-looking choice for your family office.

At Guotai Junan International, we have built an extensive and trusted network over the years, enabling us to deliver comprehensive, end-to-end family office solutions tailored to the unique needs of each client.

We operate with a client-centric philosophy, assembling a dedicated private service team to provide you with our signature “1 + N” service model:

1 Dedicated Relationship Manager

● A seasoned professional who serves as your single point of contact, offering personalized attention and seamless coordination.

N Expert Advisors Across Disciplines

● Behind every relationship manager is a team of senior experts across diverse fields—finance, legal, tax, estate planning, and more—delivering deep insights and strategic support to help you navigate every aspect of wealth management.

With this structure, we ensure that every client receives not only personalized service but also the collective expertise of a multidisciplinary team.

Begin Your Family Office Journey Here

If you're exploring the idea of setting up a family office, we offer comprehensive, end-to-end support to help you make informed decisions with confidence. From evaluating your options and analyzing key considerations to offering expert insights, our team is here to help you and your family achieve your long-term vision.

We go beyond simply helping you build the structure of your family office—we provide ongoing professional services to ensure your family’s wealth and values are preserved and passed on for generations to come.

Disclaimer

* GTJAI does not provide tax or legal advice. Before engaging in any services or making decisions, you are advised consult your own independent tax or legal advisor (or the one we refer) to obtain personalized, professional guidance tailored to your specific circumstances.

Online Service