GTJAI Asset Management Climate-related Risk Management Policy

1 Objective

1.1 This document is an overview of the policy relating to management of climate-related risks (“CRR”) in the governance, investment management and risk management in relation to both public funds and private funds managed by the Asset Management of Guotai Junan Assets (Asia) Limited (the “Company”), a wholly-owned subsidiary of Guotai Junan International Holdings Limited (“GTJAI Asset Management”).

2.1 The Board of the Company, the GTJAI Asset Management’s Investment Team and the Risk Management Team share respective responsibilities in the management of CRR in the asset management business.

2.2 The Board of the Company has overall responsibility for the CRR management strategy and performance. The Board of the Company would designate and delegate to a CRR management committee (the “Committee”) to oversee the management of CRR in the management of funds with the following responsibilities:

2.2.1 Setting CRR goal, strategy and plan, and formulating and approving the CRR risk management policy, including the CRR management criteria and acceptance levels for any specific funds or specific investee company or industry;

2.2.2 Overseeing the implementation of the CRR management policy in respect of funds under management;

2.2.3 Supervising the disclosure of the CRR management policy in accordance with applicable regulations;

2.2.4 Conducting periodical review of the CRR management policy;

2.2.5 Promoting knowledge and awareness of CRR within the company.

2.3 The Investment Team would be responsible for:

2.3.1 Considering and evaluating the CRR and their impacts in the investment process;

2.3.2 Setting and implementing suitable approach, criteria and acceptance levels in managing CRR in investment process;

2.3.3 Evaluating the effectiveness and impact of the adopted approach, criteria and acceptance levels on regular basis and making adjustment where appropriate;

2.3.4 Making disclosure of the CRR management policy in accordance with applicable law and regulations;

2.3.5 Keeping abreast of the development in CRR management, and proposing to the Committee appropriate amendment in the CRR management policy whenever necessary.

2.4 The Risk Management Team would be responsible for:

2.4.1 Implementing suitable CRR monitoring program according to the agreed CRR management criteria and acceptance levels;

2.4.2 Considering and proposing appropriate adjustment in CRR management to the Committee whenever necessary.

3 Investment Management

3.1 The Investment Team will incorporate CRR factors and considerations into their investment process, with reference to carbon risk rating, carbon exposure score, as well as risk scores in respect of ESG (Environmental, Social and Governance). Specifically, CRR ratings will be taken into account in selection of investee companies and in management of the portfolio as a whole, while ESG ratings will be considered as additional reference for both physical risks and transitional risks.

3.2 Based on the investment strategies of the funds under management, the size of operation and the resources available, we would at this stage engage external professional rating institutes to assist us in assessing the CRR.

3.3 The CRR assessment approach adopted by the engaged rating institute would be as follows:

3.3.1 The assessment would focus on the risks in relation to the value and suitability of an investment in relation to the transition to low-carbon economy.

3.3.2 The assessment would identify and take into account the risk factors such as carbon emissions, etc. and those risks associated with transition to low-carbon economy such as carbon pricing, regulatory pressure, etc.

3.3.3 Both the CRR exposure of the company’s own operations and CRR exposure of the company’s products and services will be evaluated to calculate the overall CRR exposure of the investee company.

3.3.4 The CRR score of the investee company will then be determined on the basis of (i) those CRR exposures that are not manageable and (ii) how well the company manages those CRR exposures that are manageable. The company’s CRR score is the sum of the CRR that is unmanageable and the CRR that the company does not yet manage.

3.4 For a targeted investee company to which the engaged rating institute does not provide any CRR rating, Investment Team (with the assistance of the Risk Management Team where applicable) would perform its own CRR assessment of the company. It may refer to some standards-setting organizations such as SASB Standards to identify what are the material issues the investee company is facing and what areas to look at. It may also refer to the relevant CRR data of the company, such as the CRR scoring and rating of the company’s parent or affiliate engaging in same or similar industry, and the industry or sub-industry average CRR score. Where no such CRR scoring is available, the team may refer to other CRR information and data available, such as the investee company’s GHG emission data, or if it is not available, the average GHG emission data of the industry or the sub-industry with appropriate adjustment as the investee company’s emission data. The team would prepare a CRR assessment report or commentary for such self-made rating.

3.5 For sovereign and municipal issuers, Investment Team may look at the overall CRR factors for the issuer country or region to evaluate the relevant CRR. It may refer to some available CRR data of the country or region as provided by research institutes, such as Norte Dame Research (https://gain.nd.edu/our-work/country-index/matrix). Where quantitative data are not available, the team may apply a qualitative analysis of the sovereign and municipal issuers’ CRR factors and prepare a CRR assessment report or commentary accordingly.

3.6 For an application to add a securities to the securities pool (either the equity pool or fixed income pool), the Investment Team should include in the application the CRR rating of the investee company. For an investee company with a high or severe CRR rating, Investment Team should submit with the application a CRR assessment report or commentary to set out the grounds for accepting the investee company into the pool notwithstanding its high or severe CRR rating. It is our goal to limit exposure in any investee companies that routinely produce excessive carbon emissions or which repeatedly decline to manage their climate-related risks.

3.7 When ESG rating of the investee company is available from the engaged rating institute, such ESG rating should also be included in the application for addition to the securities pool, for the Investment Committee’s and Risk Management Team’s reference. To assess the impact of these risks on the performance of investee companies, the Risk Management Team would calculate both the single name beta and also the portfolio beta for the relevant portfolio on the basis of the carbon beta provided by the engaged rating institute.

4 Risk Management

4.1 The Risk Management Team would use the CRR data and scoring provided by the engaged rating institute to monitor and review the CRR status of each fund, and prepare and present the CRR assessment to the Committee on a quarterly basis.

4.2 Based on the quarterly assessment, the Risk Management Team will alert the relevant fund manager to re-evaluate the CRR status whenever: (i) either a fund’s overall CRR score or ESG score worsens significantly; or (ii) a securities’ CRR/ESG rating is downgraded significantly. The fund manager will decide whether any action is appropriate to take, after taking into account the agreed CRR management criteria and acceptance levels.

4.3 Where there is more serious deterioration in the CRR status of an investee company, the Investment Team would determine how to adjust downward the relevant positions with reference to the latest CRR rating to restore the CRR status of the investment holding to the acceptable level. Where the Investment Team chooses to make no adjustment, it should prepare and submit to the Committee with its recommendation and justifications, for the Committee to review and make final decision.

4.4 The Risk Management Team will also monitor the portfolio carbon footprints of the Scope 1 and Scope 2 greenhouse gas (GHG) emissions associated with each individual fund. Currently the majority of the relevant data will be supplied by the engaged rating institute.

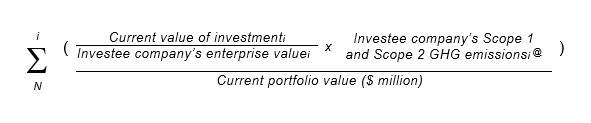

The formula for the portfolio carbon footprint is:

For companies for which scope 1 and scope 2 GHG emission data is not available, the Risk Management Team will estimate the score base on our internal model that is based on the average scores of the company’s subsector or the country origin.

4.5 In cases where emission data is not available, the Risk Management Team will either use other trusted sources or estimate the data if possible. The estimated data will be based on the company’s / sector’s high risk percentile average.

5 Engagement

5.1 Engagement refers to employing investor or shareholder power to influence corporate behavior through various forms. The purpose of engagement is to address potential severe CRR within a company and encourage sustainable actions. Through engaging, we can not only encourage better sustainable practices within the company, but also let us make more informed investment decisions. We will also be able to build long-standing relationships with the investee companies.

5.2 The format to conduct engagement might include but not be limited to physical meetings, site visits, letters, telecommunications, emails, annual general meetings, proxy voting, etc.

5.3 At any time before or after investing, the analyst may choose to engage with investee companies on issues related to including but not limited to CRR. The purpose of engaging with investee companies is to encourage sustainable practices in such companies and improve the company’s value through sustainable practices.

6 Disclosure

6.1 Appropriateinformation of our CRR management policy including governance, investment management and risk management on CRR will be disclosed publicly in the Guotai Junan International’s website in accordance with applicable law and regulation. The disclosure will be reviewed annually, and updates and enhancements to the disclosure will be made as appropriate.

- End -

Online Service